Our formula for success.

Combine our Trade Conditions checklist with the DIIO algorithms, and watch your win rate skyrocket.

Apply the checklist before every trade. The results will speak for themselves.

List 1 – General Trade Conditions

🔲 Sandwiched by breakout bar confluence in larger and smaller timeframes, but most importantly confluence in quite a few larger timeframes (C)

🔲 Do conditions in larger timeframes support my success or my failure? Pressure Lines, Movement Monitors, Breakout Bars (C)

🔲 Are Bitcoin and Total3 supporting my success or my failure? (C)

🔲 Is my trade Intelligent or Emotional? Rushing may be a sign of emotional (C)

🔲 New Trends forming with Blue on Blue or Orange on Orange. (C/E)

🔲 Proximity to pressure lines is not adverse to my trade, Is a nice gap available to profit from? (C/E)

(EXTREME CAUTION shorting near a support without a clear break or understanding of pressure and avoid longing at a resistance without a clear

break or clear assessment)

🔲 Avoid too many wicks and indecisive breakout bars everywhere. Look at the past 20 bars... (C)

(DEEP BLUE AND ORANGE disbursed throughout prior 20 bars)

🔲 Ideally find steady trends w/ minimal volatility, AVOID Choppiness (C/RM)

🔲 Always look for trades with tight asymmetry near pressure lines especially if conditions are conducive on neighboring timeframes. Tight Volatility Zones supporting your trade are a Plus. Long Green under orange on orange. Short Red over Blue on Blue (C/E)

Did I check this?

🔲 Is this trade worth it given the numbers? Some trades aren't worth being a part of for different reasons?

Asymmetry too low? too close to pressure line? Take Profit too close?

Best Logical stoploss is too far away? etc.

(perhaps consider the inverse trade if the numbers don't look good)

🔲 Is there room on the relevant linear regression channels (200)? (C)

OR are Channel Breaks in the smaller timeframes or relevant timeframes supporting my success or failure? (C)

NOTE: ALL conditions above should be met before proceeding below. If not, consider discontinuing the trade.

List 2 – Entry (E) Considerations Pt. 1

🔲 Given proximity to pressure lines, does the asymmetry work well for 8:1 at a minimum? Ideally higher. (E)

🔲 Consider a Retrace into Volatility zone or 21 EMAs for entry-provided larger scale conditions are still favorable. (E)

🔲 Am I considering Deviation on Bollinger Bands or Linear Regression? Caution in longing when overextended Bullish.

Caution if shorting when overextended Bearish. If using significant leverage, mind the scalping timeframes as well. (E)

🔲 Are my entries, exits, stoplosses based on factual logical data? (E/RM) (Rushing or arbitrarily choosing stoploss points often leads to loss as there is otherwise no real reason for the price action to stop anywhere near that arbitrary point)

🔲 Is my entry relatively close to the base (Movement Monitor) for the timeframes I am considering?

Avoid entry when overextended significantly from the relevant Movement Monitors. The 2hr and 4hr are often good ones to review for scalping and intra day. The 1D and 3D are more appropriate to review for multi-day swing trades. When taking positions on overextended price action, you'll need to consider small timeframe data. Avoid anything overextended from the bases on the majority of timeframes. The price generally retraces to the

base or the base will need to catch up to the price action. (E/RM)

🔲 Is it possible to utilize a reasonably close volatility cloud (using the most relevant settings) to ensure I have a statistically sound "Stop Loss" plan? (E) Entry Plan? Considered volatility risks? Sound Asymmetry?

NOTE: ALL conditions above should be met before proceeding below. If not, consider discontinuing the trade.

List 3 – Entry (E) Considerations Pt. 2

🔲 How much will I lose if I lose? Can I honestly live with that kind of loss many times over comfortably? Will it affect me emotionally if I lost this 4 or 5 times in a row? If so... it is too much. (RM) Is this well thought out?

🔲 Leverage Selection Am I sure I want to magnify this trade? If so, by how much do I really want to magnify it?" Am I comfortable with the downside? Am I playing within my DOJO belt level (Proven Consistent 20% win ratio at lower leverages)? (RM)

🔲 Is the setup so great that it warrants magnification over 8x? WHY? (RM)

🔲 Is my risk mitigation intelligent based on my stop loss percentage? absolute values? position size? Or all 3? (RM)

NOTE: ALL conditions above should be met before proceeding. IF NOT, consider discontinuing the trade.

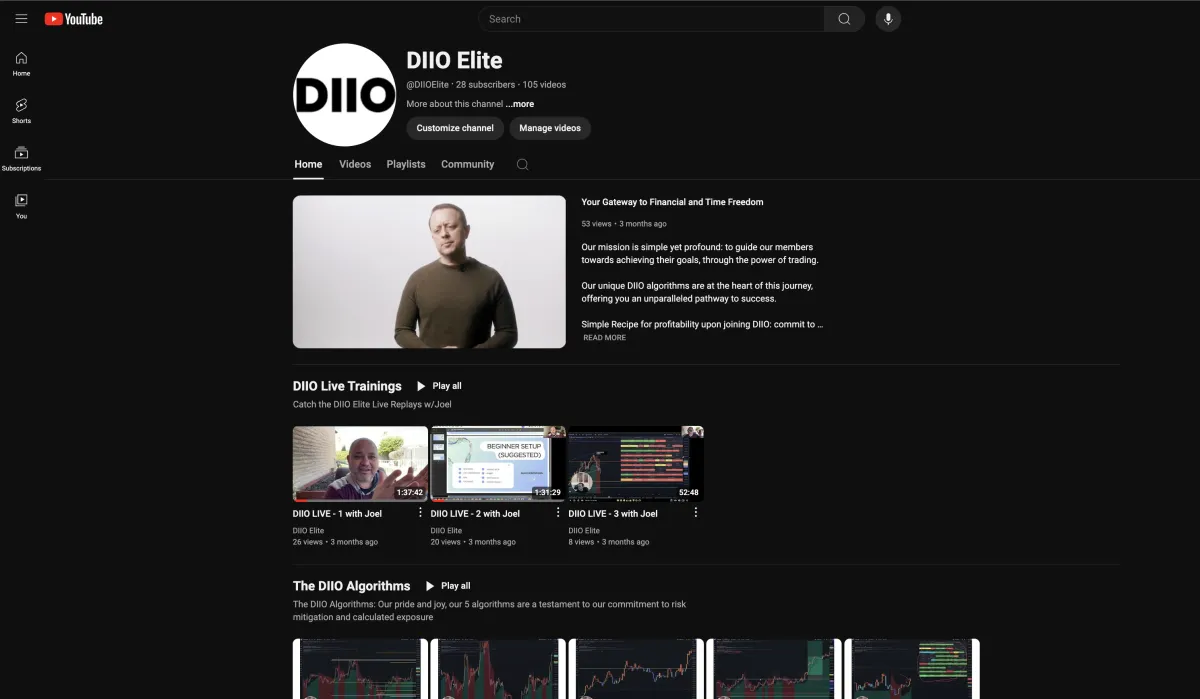

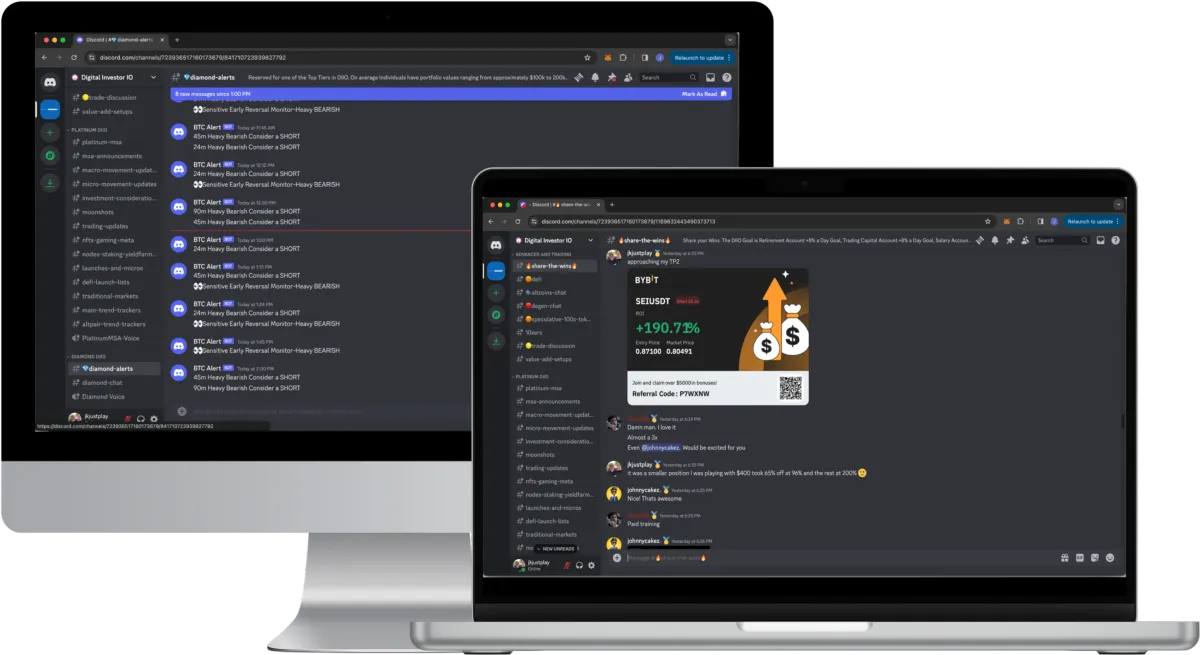

Where we go, you go too.

Join our vibrant community today and take the first step towards mastering trading. Our free Discord channel offers a dynamic platform for discussions, tips, and insights from fellow trading enthusiasts and experts. Complementing this is our easy-to-use free YouTube Channel packed with essential content designed to elevate your trading skills. These resources are your gateway to the world of DIIO, where every member is on a journey to financial and time freedom. Sign up now and start transforming your trading experience.

Explore our community and learn more.